Who Pays Transfer Tax In Michigan . In michigan, the responsibility for paying transfer taxes can differ based on the. property transfer tax is an assessment charged by both the state of michigan and the individual county. When you transfer real estate, they charge a fee. short answer michigan transfer tax: who pays for transfer taxes? Michigan imposes a transfer tax of $8.60 per $1000 of the value of real. the michigan real estate transfer tax is a tax on written instruments—like deeds—that transfer an. in accordance with the michigan constitution as amended by proposal a of 1994, a transfer of ownership will cause the taxable value. michigan statute defines “transfer of ownership” generally as the conveyance of title to or a present interest in property,.

from www.uslegalforms.com

in accordance with the michigan constitution as amended by proposal a of 1994, a transfer of ownership will cause the taxable value. In michigan, the responsibility for paying transfer taxes can differ based on the. When you transfer real estate, they charge a fee. property transfer tax is an assessment charged by both the state of michigan and the individual county. who pays for transfer taxes? Michigan imposes a transfer tax of $8.60 per $1000 of the value of real. the michigan real estate transfer tax is a tax on written instruments—like deeds—that transfer an. michigan statute defines “transfer of ownership” generally as the conveyance of title to or a present interest in property,. short answer michigan transfer tax:

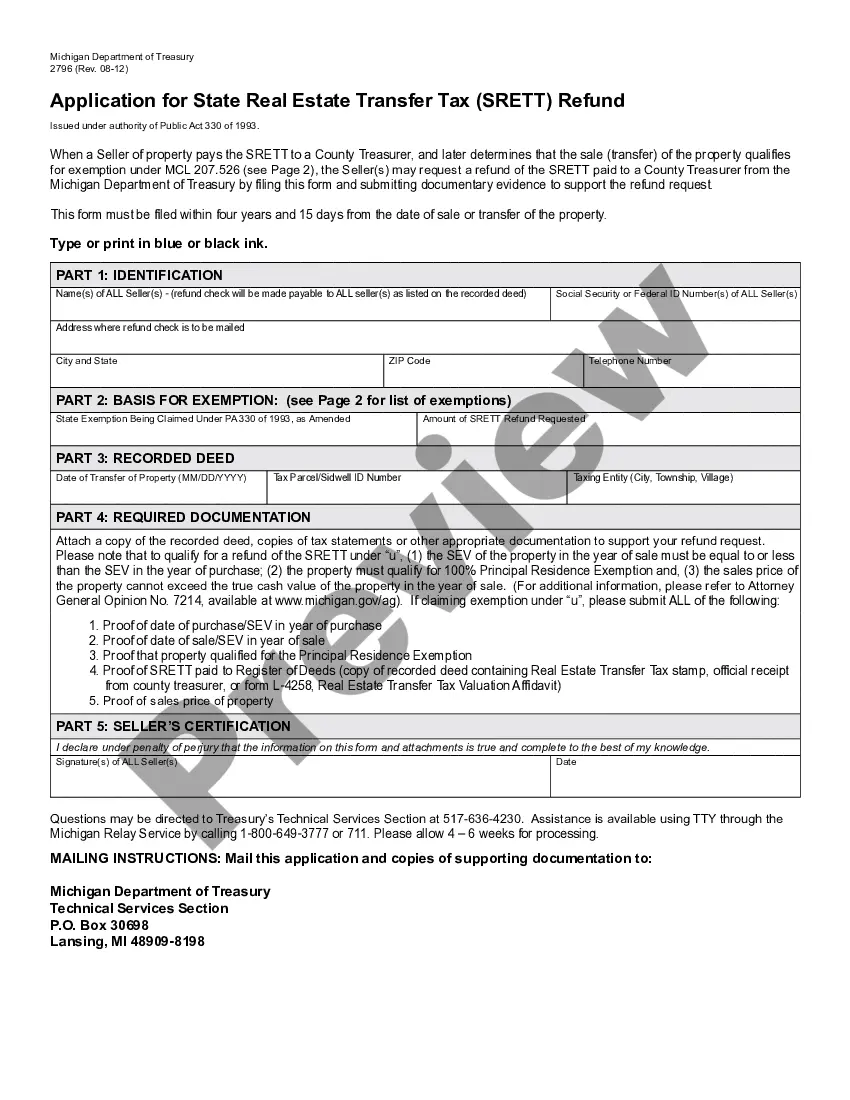

Michigan Application for Real Estate Transfer Tax Refund State Of

Who Pays Transfer Tax In Michigan Michigan imposes a transfer tax of $8.60 per $1000 of the value of real. the michigan real estate transfer tax is a tax on written instruments—like deeds—that transfer an. In michigan, the responsibility for paying transfer taxes can differ based on the. Michigan imposes a transfer tax of $8.60 per $1000 of the value of real. property transfer tax is an assessment charged by both the state of michigan and the individual county. short answer michigan transfer tax: michigan statute defines “transfer of ownership” generally as the conveyance of title to or a present interest in property,. When you transfer real estate, they charge a fee. who pays for transfer taxes? in accordance with the michigan constitution as amended by proposal a of 1994, a transfer of ownership will cause the taxable value.

From www.slideshare.net

MI1040CR7booklet_michigan.gov documents taxes Who Pays Transfer Tax In Michigan Michigan imposes a transfer tax of $8.60 per $1000 of the value of real. property transfer tax is an assessment charged by both the state of michigan and the individual county. the michigan real estate transfer tax is a tax on written instruments—like deeds—that transfer an. When you transfer real estate, they charge a fee. In michigan, the. Who Pays Transfer Tax In Michigan.

From www.uslegalforms.com

Michigan Application for Real Estate Transfer Tax Refund State Of Who Pays Transfer Tax In Michigan property transfer tax is an assessment charged by both the state of michigan and the individual county. short answer michigan transfer tax: In michigan, the responsibility for paying transfer taxes can differ based on the. the michigan real estate transfer tax is a tax on written instruments—like deeds—that transfer an. michigan statute defines “transfer of ownership”. Who Pays Transfer Tax In Michigan.

From www.mlive.com

Highlights of IRS data from Michigan tax returns Who Pays Transfer Tax In Michigan in accordance with the michigan constitution as amended by proposal a of 1994, a transfer of ownership will cause the taxable value. who pays for transfer taxes? In michigan, the responsibility for paying transfer taxes can differ based on the. the michigan real estate transfer tax is a tax on written instruments—like deeds—that transfer an. short. Who Pays Transfer Tax In Michigan.

From www.sampleforms.com

FREE 6+ Land Transfer Form Samples in PDF MS Word Who Pays Transfer Tax In Michigan Michigan imposes a transfer tax of $8.60 per $1000 of the value of real. short answer michigan transfer tax: When you transfer real estate, they charge a fee. property transfer tax is an assessment charged by both the state of michigan and the individual county. the michigan real estate transfer tax is a tax on written instruments—like. Who Pays Transfer Tax In Michigan.

From www.studocu.com

[Practice Quiz No. 1] Transfer Taxes 1/ Imposed upon gratuitous Who Pays Transfer Tax In Michigan michigan statute defines “transfer of ownership” generally as the conveyance of title to or a present interest in property,. in accordance with the michigan constitution as amended by proposal a of 1994, a transfer of ownership will cause the taxable value. the michigan real estate transfer tax is a tax on written instruments—like deeds—that transfer an. . Who Pays Transfer Tax In Michigan.

From stagingnew.upnest.com

Transfer Tax in Marin County, California Who Pays What? Who Pays Transfer Tax In Michigan Michigan imposes a transfer tax of $8.60 per $1000 of the value of real. short answer michigan transfer tax: who pays for transfer taxes? property transfer tax is an assessment charged by both the state of michigan and the individual county. the michigan real estate transfer tax is a tax on written instruments—like deeds—that transfer an.. Who Pays Transfer Tax In Michigan.

From www.benchmarkta.com

Mortgage Tax & Transfer Tax Benchmark Title Agency, LLC Who Pays Transfer Tax In Michigan michigan statute defines “transfer of ownership” generally as the conveyance of title to or a present interest in property,. Michigan imposes a transfer tax of $8.60 per $1000 of the value of real. who pays for transfer taxes? property transfer tax is an assessment charged by both the state of michigan and the individual county. In michigan,. Who Pays Transfer Tax In Michigan.

From www.drawingdetroit.com

Michigan taxes Drawing Detroit Who Pays Transfer Tax In Michigan in accordance with the michigan constitution as amended by proposal a of 1994, a transfer of ownership will cause the taxable value. property transfer tax is an assessment charged by both the state of michigan and the individual county. michigan statute defines “transfer of ownership” generally as the conveyance of title to or a present interest in. Who Pays Transfer Tax In Michigan.

From pierrecarapetian.com

Ontario Land Transfer Tax Who Pays? Calculator Exemptions Rebates Who Pays Transfer Tax In Michigan who pays for transfer taxes? Michigan imposes a transfer tax of $8.60 per $1000 of the value of real. in accordance with the michigan constitution as amended by proposal a of 1994, a transfer of ownership will cause the taxable value. When you transfer real estate, they charge a fee. the michigan real estate transfer tax is. Who Pays Transfer Tax In Michigan.

From areslaw.ca

Land Transfer Taxes & What You Need to Know Ares Law Who Pays Transfer Tax In Michigan who pays for transfer taxes? short answer michigan transfer tax: the michigan real estate transfer tax is a tax on written instruments—like deeds—that transfer an. Michigan imposes a transfer tax of $8.60 per $1000 of the value of real. property transfer tax is an assessment charged by both the state of michigan and the individual county.. Who Pays Transfer Tax In Michigan.

From www.youtube.com

Michigan State Taxes Explained Your Comprehensive Guide YouTube Who Pays Transfer Tax In Michigan short answer michigan transfer tax: in accordance with the michigan constitution as amended by proposal a of 1994, a transfer of ownership will cause the taxable value. When you transfer real estate, they charge a fee. Michigan imposes a transfer tax of $8.60 per $1000 of the value of real. who pays for transfer taxes? In michigan,. Who Pays Transfer Tax In Michigan.

From www.youtube.com

TAX DECLARATION How to transfer tax declaration to the new owner Who Pays Transfer Tax In Michigan who pays for transfer taxes? short answer michigan transfer tax: the michigan real estate transfer tax is a tax on written instruments—like deeds—that transfer an. In michigan, the responsibility for paying transfer taxes can differ based on the. property transfer tax is an assessment charged by both the state of michigan and the individual county. Michigan. Who Pays Transfer Tax In Michigan.

From www.pdffiller.com

2010 Form MI DoT 4567 Fill Online, Printable, Fillable, Blank pdfFiller Who Pays Transfer Tax In Michigan In michigan, the responsibility for paying transfer taxes can differ based on the. michigan statute defines “transfer of ownership” generally as the conveyance of title to or a present interest in property,. Michigan imposes a transfer tax of $8.60 per $1000 of the value of real. short answer michigan transfer tax: the michigan real estate transfer tax. Who Pays Transfer Tax In Michigan.

From virginawbrynna.pages.dev

Michigan Tax Calculator 2024 Gaby Pansie Who Pays Transfer Tax In Michigan When you transfer real estate, they charge a fee. Michigan imposes a transfer tax of $8.60 per $1000 of the value of real. property transfer tax is an assessment charged by both the state of michigan and the individual county. in accordance with the michigan constitution as amended by proposal a of 1994, a transfer of ownership will. Who Pays Transfer Tax In Michigan.

From ultimateestateplanner.com

2024 Generation Skipping Transfer Tax Chart Ultimate Estate Planner Who Pays Transfer Tax In Michigan in accordance with the michigan constitution as amended by proposal a of 1994, a transfer of ownership will cause the taxable value. Michigan imposes a transfer tax of $8.60 per $1000 of the value of real. When you transfer real estate, they charge a fee. property transfer tax is an assessment charged by both the state of michigan. Who Pays Transfer Tax In Michigan.

From www.compareclosing.com

The Detailed Guide To Transfer Tax And The 3 Types Of It Who Pays Transfer Tax In Michigan who pays for transfer taxes? in accordance with the michigan constitution as amended by proposal a of 1994, a transfer of ownership will cause the taxable value. the michigan real estate transfer tax is a tax on written instruments—like deeds—that transfer an. property transfer tax is an assessment charged by both the state of michigan and. Who Pays Transfer Tax In Michigan.

From www.withholdingform.com

Michigan 2022 Annual Tax Withholding Form Who Pays Transfer Tax In Michigan in accordance with the michigan constitution as amended by proposal a of 1994, a transfer of ownership will cause the taxable value. When you transfer real estate, they charge a fee. michigan statute defines “transfer of ownership” generally as the conveyance of title to or a present interest in property,. Michigan imposes a transfer tax of $8.60 per. Who Pays Transfer Tax In Michigan.

From listwithclever.com

What Are Transfer Taxes? Who Pays Transfer Tax In Michigan property transfer tax is an assessment charged by both the state of michigan and the individual county. who pays for transfer taxes? michigan statute defines “transfer of ownership” generally as the conveyance of title to or a present interest in property,. When you transfer real estate, they charge a fee. the michigan real estate transfer tax. Who Pays Transfer Tax In Michigan.